In the latest economic news, reports indicate that the Consumer Price Index (CPI) is showing signs of easing, a development that has excited investors and traders in the stock market. This shift has caused a positive reaction in various market sectors, especially as the Federal Reserve is expected to hold interest rates steady this month, putting an end to a series of cuts that have taken place over recent months.

Traders’ Optimism Grows

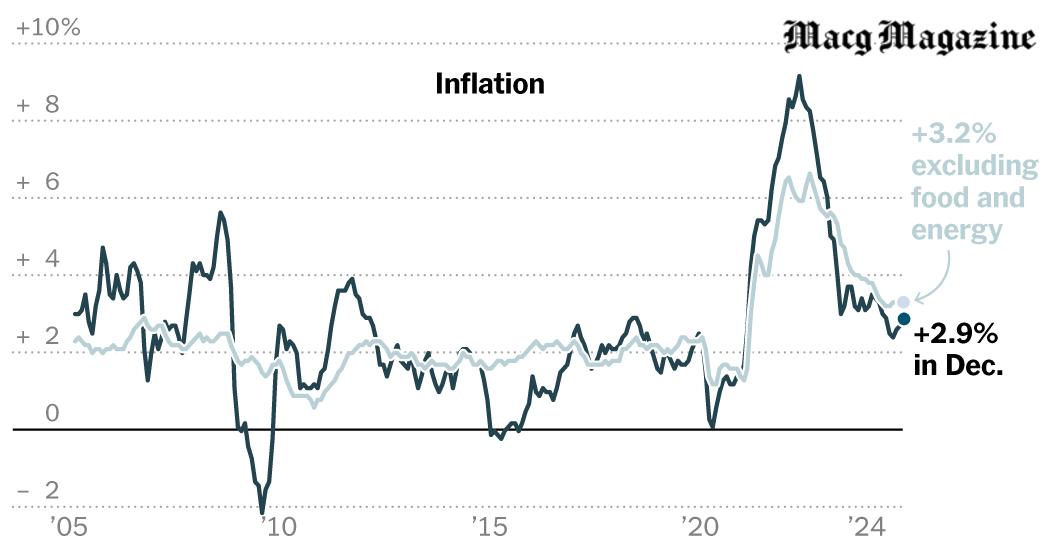

The CPI, which measures the change in prices for everyday goods and services, rose by 0.4% in December, bringing the annual inflation rate to 2.9%. Additionally, the Core CPI, which excludes food and energy prices, increased by just 0.2% in December. This is a significant slowdown compared to previous months and signals that inflation fears may be easing. As a result, many traders are feeling optimistic about the direction of the stock market.

Stock Market Surges

On Wednesday, January 11, 2024, U.S. stocks rallied impressively, with the S&P 500 increasing by over 1.8%, while the Dow Jones Industrial Average saw a rise of more than 1.6%, climbing over 700 points. The Nasdaq Composite also experienced a boost, with an impressive increase of 2.5%. The positive performance was largely driven by investors reacting to lower-than-expected CPI figures and excellent earnings reports from major banks.

Strong Bank Earnings Fuel Expectations

Big banks like JPMorgan Chase and Goldman Sachs reported strong quarterly earnings that exceeded expectations, further fueling optimism in the stock market. JPMorgan Chase’s fourth-quarter profit surged by 50% to reach $14 billion, with revenues climbing by 10% to $43.74 billion. Similarly, Goldman Sachs reported a remarkable doubling of its fourth-quarter profit year-over-year, totaling $4.11 billion, with a revenue increase of 23% to $13.87 billion. These stellar performances from major financial institutions have helped to boost market confidence.

What This Means for You

For everyday Americans, this news about easing inflation and strong bank performance could have various implications for personal finances. Lower inflation rates might mean that prices of essential goods could stabilize or even decline, allowing families to keep more money in their pockets. However, economists also suggest that the anticipated economic impact of the incoming administration’s policies might include some upward pressure on prices, so it’s essential to remain cautious.

The Federal Reserve’s Next Moves

The Federal Reserve is expected to closely monitor these developments. They anticipate that inflation will cool gradually, which could alter their decisions regarding interest rates in the future. Currently, many Fed officials are not pursuing additional rate cuts, as the labor market remains stable, and inflation is hovering above their target levels. The decision to wait and see might give them more clarity on how to proceed.

The Global Context

In addition to domestic news, another important global factor that could affect markets is the recent ceasefire deal reached between Israel and Hamas. This agreement marks an important step towards peace, which often influences economic stability in the region and can also impact global markets. Investors are likely to be cautious as they assess the broader implications of such geopolitical changes.

Quick Summary of Market Performances

| Stock Index | Change (%) |

|---|---|

| S&P 500 | +1.8 |

| Dow Jones | +1.6 |

| Nasdaq | +2.5 |

In conclusion, as the CPI reflects signs of stabilization, the stock market has shown a positive response, encouraging many investors to feel hopeful about the future of the economy. While there are still uncertainties, especially concerning upcoming policies and global events, the overall sentiment suggests a cautious optimism among traders and consumers alike.